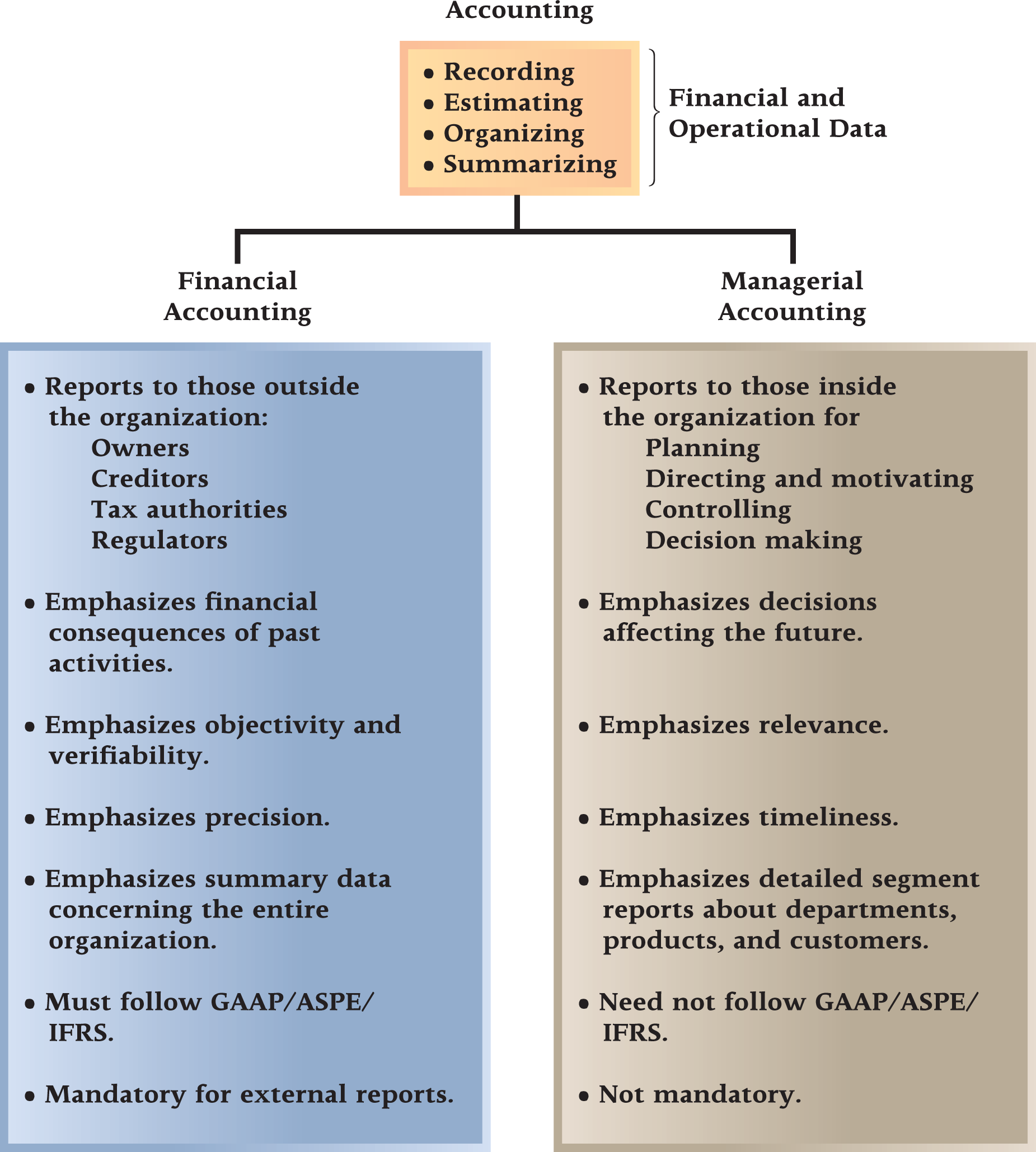

financial accounting is outside looking in, managerial accounting is inside, also looking in

Managerial accounting provides data that help organisations run more efficiently.

Financial accounting provides the scorecard by which a company’s past performance is judged.

Managerial accounting concerns developing information and analysis to help managers make business decisions that satisfy customers and other stakeholders while continuously monitoring costs and improving efficiencies.

Management accountants to prepare a variety of reports.

Some reports compare actual results to plans and to benchmarks focusing on how well managers or business units have performed. Other reports provide timely updates on key non-financial and financial indicators, such as orders received, customer acquisition costs, customer satisfaction, and sales. Reports may also be prepared as needed to help investigate specific problems, such as a decline in profitability of a product line, or to help decide whether to outsource some of the business operations. In contrast, financial accounting focuses on a limited set of specific quarterly and annual financial statements prepared in accordance with generally accepted accounting principles (GAAP) and government regulations.

Financial accounting reports are prepared for external parties, such as shareholders and creditors, whereas managerial accounting reports are typically prepared for individuals inside the organization.

Emphasis on the Future

Since planning is such an important part of the manager’s job, managerial accounting has a strong future orientation. In contrast, financial accounting primarily summarizes past financial transactions. These summaries may be useful in planning, but only to a point. Changes are constantly taking place in economic conditions, customer needs and desires, competitive conditions, and so on. All of these changes require that managers’ planning be based in large part on estimates of what will happen rather than on summaries of what has already happened.

Relevance of Data

Financial accounting data are expected to be objective and verifiable. However, for internal use, managers need information that is relevant even if it is not completely objective or verifiable.

By relevant, we mean appropriate for the decision being made.

For example, it is difficult to verify estimated sales volumes for a new product, but this is exactly the type of information that is most useful to managers in their decision making. Managerial accounting should be flexible enough to provide whatever data are relevant for a particular decision.

Less Emphasis on Precision

Making sure that amounts are highly accurate can take time and effort. While a high degree of accuracy is required for external reports, most managers would rather have timely information than have to wait for more accurate information. Moreover, some decisions such as product pricing or major investments are highly time sensitive and need to be made quickly. For this reason, management accounting often places less emphasis on precision than financial accounting. For example, in a decision involving hundreds of millions of dollars, estimates that are rounded to the nearest million dollars are probably good enough.

Because managerial accounting is not bound by GAAP, managers have flexibility to determine the content and form of internal reports to best suit the needs of the organization.

Managerial accounting is not mandatory. No regulatory bodies or other outside agencies specify the information that has to be compiled, analyzed, or reported internally. Since managerial accounting is completely optional, before compiling, analyzing, and reporting information internally managers must always ask themselves “Will the information be beneficial?” rather than “Is the information required?”

North: Where X comes from

East: What is the opposite of X?

South: Where X leads to?

West: What's similar to X?